Commodities

Let’s start off with Brent Crude.

Brent saw a 5.14% again this week and is currently sitting at 65.2$ a barrel after it found demand at the 60$ mark. This comes amid International turmoil regrading America blaming Iran of bombing tankers in the Gulf of Oman. Is war irrupts between America and Iran, it could influence the price of Oil dramatically, as Iran is a major oil producing country.

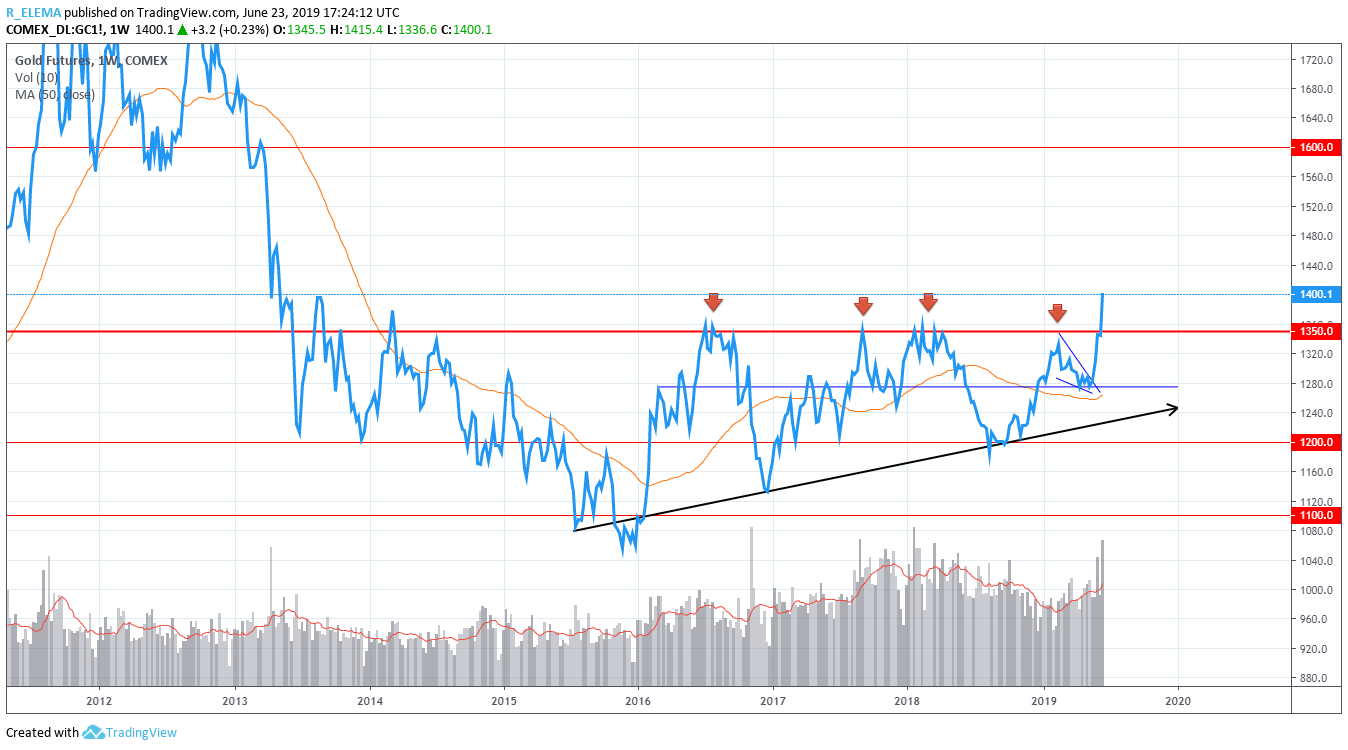

Gold sits at 1398.65$ at time of writing and saw a 4.27% gain this past week after if started testing the 1350$ major resistance line again on June 7th and blasted through on June 20. This is a major event for Gold, as it has rejected from the 1350$ mark repeatedly since 2015, as can be seen in the below image.

Gold (GC1!) Weekly Timeframe.

Silver it seems followed Gold example, and has recorded a 3.24% gain to a price of 15.35$ this week, supported by massive volume spikes since the start of the June.

Currencies

The ZAR posted a gain of 3.47% against the USD this week and rests at R14.304 currently.

The JSE

The Top40 gained 1.4% this week with the AllShare closing 1.28% higher at 58 941 points.

The Financials Sector won the race this week with a 2.92% gain, and Utilities was the king of the losers with a almost four percent negative close.

Under the Basic Materials Sector, the Gold industry gained a round 3% this week, supported by the rally in the price of Gold. Construction Materials (Industry) gained a impressive 5.22% gain this week courtesy of Afrimat (+11.3%) and Sephaku Holdings (9.27%)

Consumer Cyclical’s (Sector) gains where partly the result of MaltiChoice’s 5.78% growth after the company released some impressive financial results. Steinhoff on the other hand fell a full 18.18% this week after disastrous financial results where released.

Apparel & Accessories Retailers grew by 3.8%, possibly on the back of good Retail Data that was released on the 12th of June Indicating that Retail Sales had beaten Forecast by 0.7% after coming in at 2.4% for the month of April YoY.

The Financials (Sector)’s performance could largely be attributed to the Banking (Industry) gaining 4.41%., with no bank closing on the red on a weekly time frame.

I have no idea what I’m doing – but at least I’ve made one post. The first of many more to come. Hold on to your hats, people.